By: Forrest Lee

As the electrification of America’s commercial fleets continues to accelerate, companies are recognizing the astounding business & economic opportunities accompanied by Electric Vehicles (EVs), from productivity gains and reduced operating costs, to achieving their Environmental, Social & Governance (ESG) Key Performance Indicators (KPIs) and reduction in harmful GHG and Toxic air emissions.

Some fleets set to make the transition by 2030 include Amazon, who plans to replace 100,000 Internal Combustion Engine (ICE) delivery vehicles with EVs, UPS with 10,000 EV replacements, Unilever with 11,000 EV replacements, and Siemens with 50,500 EV replacements. Furthermore, the Federal government has committed to upgrading their existing fleet of 645,000 vehicles to US-made electric vehicles, as well as passing an infrastructure bill that shows significant support for development of EV infrastructure across the US.

A Cost-Benefit Analysis of EV Fleets

While upfront costs may be one of the most prevalent barriers to the nation-wide adoption of commercial EVs, operators must look past this to see the bigger picture. The long-term financial benefit is greater for EV fleets due to falling costs, widening availability, superior efficiency, and moderate electricity prices across the US.

According to The Climate Group:

The most significant barriers reported by EV100 members were lack of charging infrastructure (67%), lack of correct vehicle type (64%) and capital cost of EVs (58%), with light-commercial and heavy-duty vehicles cited as the most challenging vehicle types.

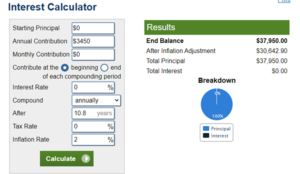

Based on an average usage of 25,000 miles per year, companies can save $3,450 in fuel costs per fleet vehicle per year by transitioning from ICE fleet vehicles to EVs. This translates to a fuel savings of $37,260 per fleet EV over its working lifespan. With fleet EVs costing approximately $12,000 more than comparable ICE fleet vehicles at MSRP, the reduction in operating cost for the EV is more than adequate. Extrapolating these fuel savings to a company with 20 fleet EVs, we find that first year fuel savings are $69,000. With Level 2 chargers costing $2,500 installed, 20 Level 2 chargers would cost approximately $50,000, equating a net savings due to fuel cost of $19,000. Over the lifespan of the 20 fleet EVs, the company will save approximately $613,000 (in 2021 dollars) on fuel costs. **

Revenue Generating Capabilities of EV Charging

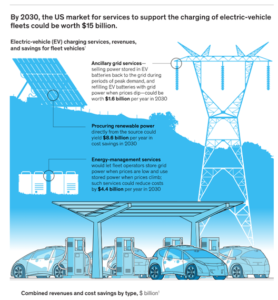

Deploying fleet EV charging stations within a microgrid will afford companies the ability to draw and store electricity during low usage periods, as well as sell electricity to the grid when usage surges and rates increase dramatically. McKinsey1 estimates that “services to support the charging of EV fleets could be worth some $15 billion in annual revenues and cost savings,” and anticipates most of the revenue and cost savings coming from the activities as shown in their infographic below:

Source: mckinsey.com

To summarize, there are five activities that could bring in the majority of the projected revenue:

- Contributing power stored in EV batteries back to the grid (vehicle-to-grid, V2G) during peak demand and recharging during off-peak times – could be worth $1.6 billion per year in 2030.4

- Company owned renewable generation at charging site – could be worth $8.6 billion per year in cost savings in 2030.4

- Energy-management services such as battery energy storage and solar power generation to store and generate power during lower rate periods and sell the stored power when prices are high. Additionally, local battery storage could be utilized during off-peak times to subsidize the required electricity from the electric grid – could be worth $4.4 billion per year in 2030.1

- Curtail peak-load with a workplace demand side management system to throttle EV charging stations depending on aggregate building electricity demand.4

- Reduce peak-load with a control system that uses energy needs and the state-of-charge to improve charge-management performance.4

For assistance on planning or implementing the electrification of your fleet, please contact Emily Norkus, our Business Development Lead for EV and BESS initiatives.

**Assessment made September 2021

1) Charging electric-vehicle fleets: How to seize the emerging opportunity – McKinsey

Assumptions for Cost-Benefit Analysis:

$3.50/gallon

20 mpg

$0.20/kWh

100 miles/day

250 working days

17.5$/day for ICE

3.75$/day for EV

Average fleet vehicle lifespan: 10.8 years